Leaving a Legacy

Thank you! One of the most significant ways to invest in the future of the Down syndrome community is to start the conversation with your loved ones, family, and friends about how you can impact the lives of individuals, caregivers, and more – all through a legacy gift to the Canadian Down Syndrome Society.

Your Will

Whether you designate a specific amount or leave a percentage of your estate, your legacy gift will empower Canadian Down Syndrome Society’s continued work on advocacy, resources, and unique projects. This is an easy and cost-effective way to invest in the future of CDSS!

Sample Will Language

I [name], of [city, province (state), postal code (zip)], bequeath the sum of $[ ] CAD / USD or [ ] percent of my estate to the Canadian Down Syndrome Society, a nonprofit organization with a business address of 220-1 First Street, Collingwood, Ontario, L9Y 1A1 and a registered charitable tax number of 118830751 RR0001 for its unrestricted use and purpose.

Why Include a Charitable Donation in Your Will?

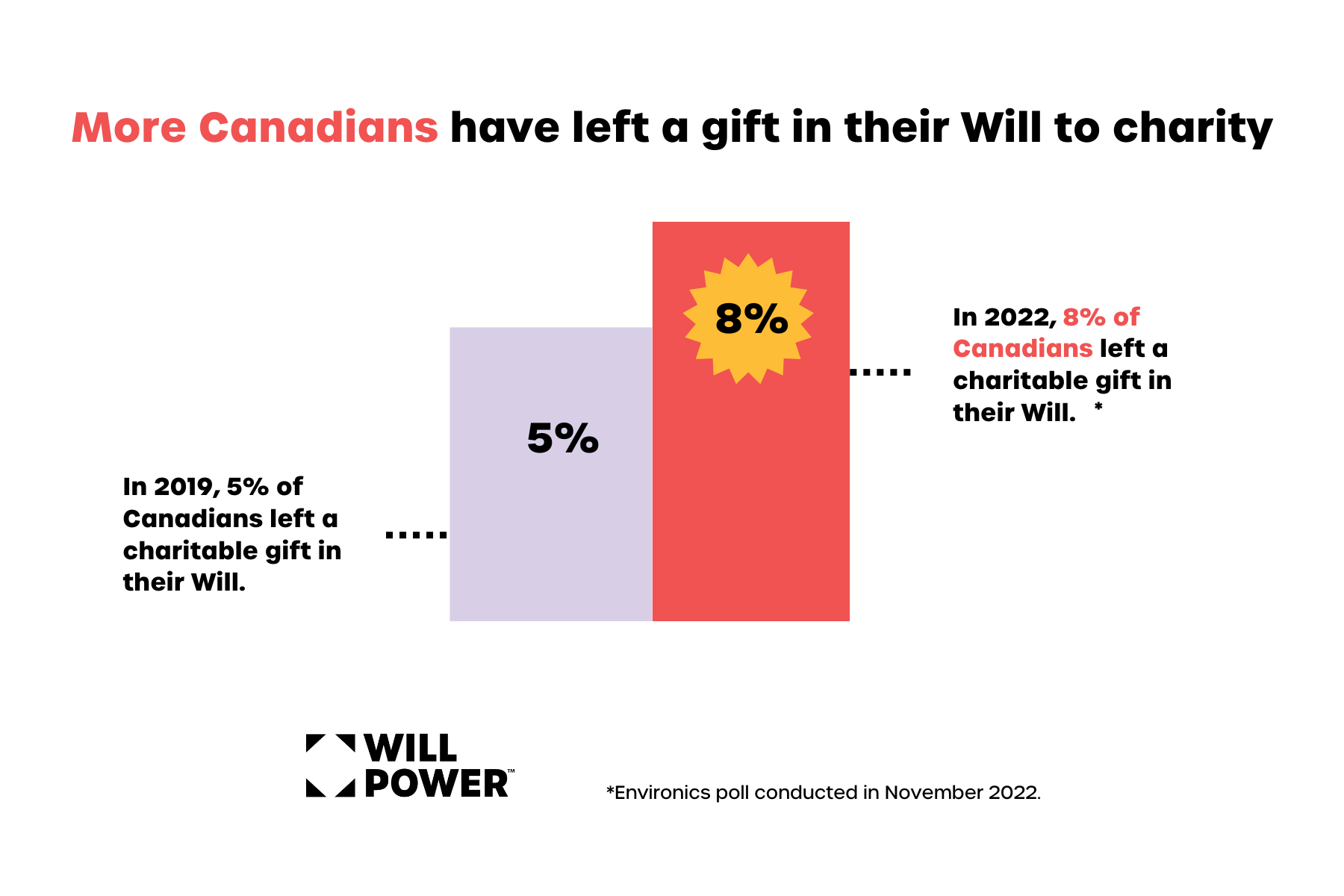

Leaving a donation in your will for a charity is a growing trend in Canada. Why is legacy giving becoming more popular? With the rising cost of living, people are looking for ways to donate without straining their current financial resources. By leaving even just 1% of their estate to charity, they can make a dramatic impact in the work we do for Canadians with Down syndrome and their families.

Gifts of Life Insurance

When you give a new or existing life insurance policy to the Canadian Down Syndrome Society (CDSS), you’re turning small monthly premiums into a significant gift. The insurance benefit will eventually be paid directly to CDSS and is separate from your estate, so there are no administrative costs or probate fees. Your gift has no effect on your estate’s assets, and you will receive a charitable tax receipt that can be used in your lifetime, or for your estate.

Gifts of Retirement Savings Plans

Another convenient way to leave a gift to CDSS is through RRSPs (Registered Retirement Savings Plans) and RRIFs (Registered Retirement Income Funds).

These types of gifts qualify for tax credits and help offset the tax implications of the withdrawal on your final income tax return.

There are many financial and philanthropic considerations as you prepare your final wishes and we appreciate your thoughtfulness and trust in CDSS. We encourage you to reach out at any time to discuss how your legacy will impact families for years to come.

Gregg Bereznick GreggB@CDSS.ca or 403.270.8500

*All gift intentions should be reviewed by legal counsel and/or financial advisors to ensure you have outlined your legacy appropriately.