Donating to Charity in Your Will: The Why and The How

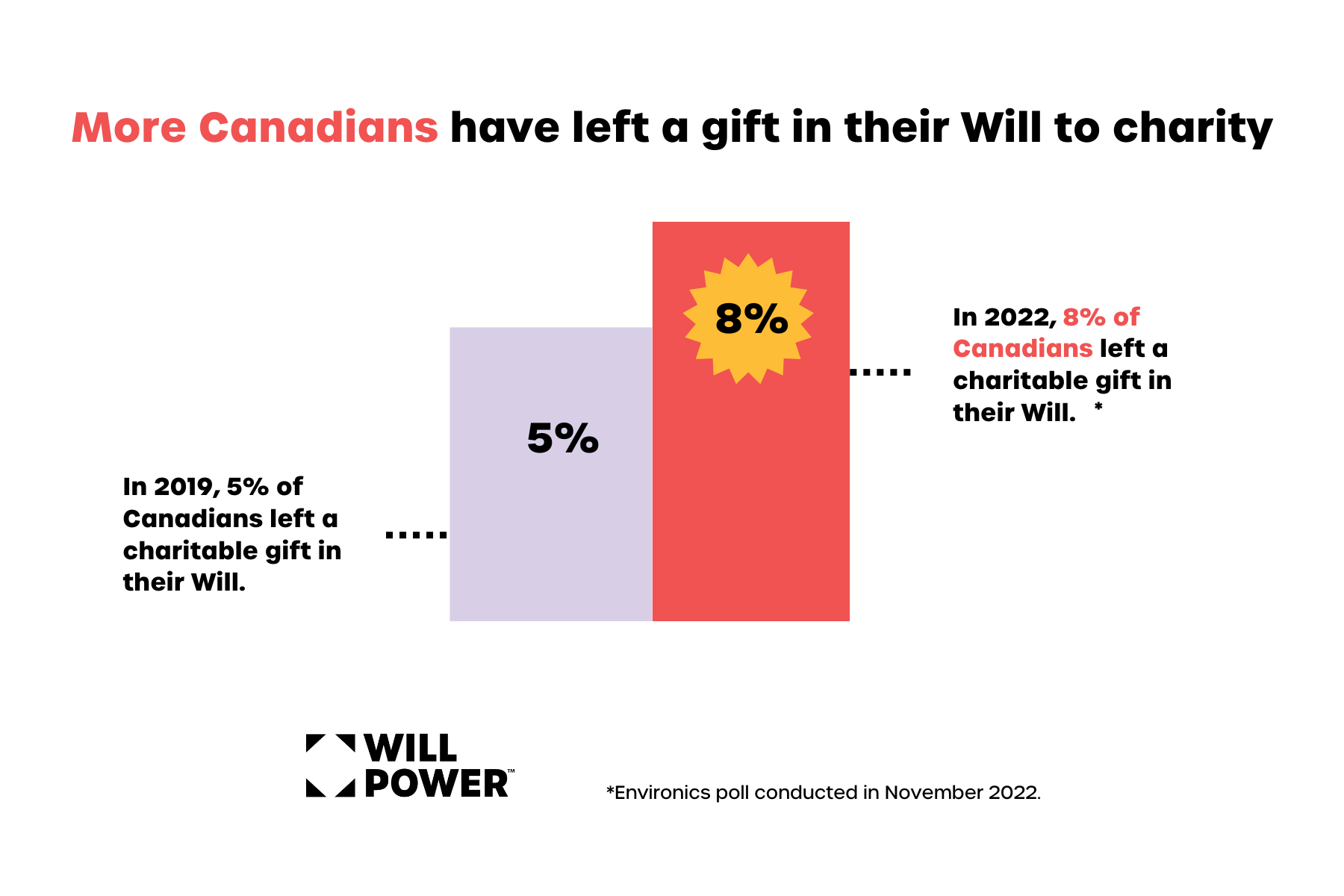

Did you know that you can set aside money for charity in your Will? You may have heard this called planned or legacy giving, and according to a recent Will Power study, there has been a significant 3% increase in Canadians who are doing it.

In actual numbers, that’s 1.2 million more Canadians donating to charity in their Wills, creating roughly $37 billion in future donations.

Think about how much good $37 billion could do…how many acres of forest could be saved, how many diseases eradicated, how many people lifted out of poverty.

Think about what a difference we could make in the lives of Canadians with Down syndrome and their caregivers.

Why the Surge in Legacy Giving?

One obvious reason is an economy forcing us all to hold our wallets a little (or a lot) tighter. Donating in your Will lets you make a big difference without using the money you need now. Even 1% in your Will could make quite the impact.

This, coupled with an urgency to do something in the face of growing global need, has made gifts in Wills a popular solution. Inflation and cost of living may have put pressure on Canadian incomes, but the desire to help has never been stronger. Donating in your will is a way for people to drive the kind of change they want to see while being well within their reach.

Another reason is demographics. Roughly a trillion dollars will be passed down over the next 10 years, the biggest wealth transfer in history. It’s given many of us pause, realizing we probably will have enough to support family AND a charity in our Wills.

Four Reasons to Donate to Charity in Your Will

1. Contribute more than you could otherwise.

Our donors are always amazed when we tell them how far their donations stretch, and how much more we can do for the Down syndrome community with every extra dollar.

When we show them what a small percentage in their Will to CDSS could look like, they do the math and their eyes light up.

Remember, that the value of your “estate” is the sum of any property and/or business you own, your pension and/or registered funds, any securities like stocks or mutual funds, any cash savings, and life insurance. It adds up, even if you subtract debt.

In fact, the average Canadian family in 2023 had a net worth of $981,816. If you put just 1% of that aside for charity, you’d be looking at a donation of about $10,000! When else could the average Canadian make such an extraordinary impact?

Curious about how a gift in your Will can shape the future? Discover how one dedicated donor’s commitment is set to make a lasting impact.

Small Thing, Big Impact: Gail’s Legacy Giving Story

“Adam was born 37 years ago. When we brought him home from the hospital, Brian and I were desperate for information and support to help us understand Down syndrome and how to help Adam.

Little did I know when I connected with CDSS in 1989 that I would help shape resources, networks and especially a legacy gift that ensures there are funds when needed.

Today Adam is working and living in a supportive home and we are so thankful to the supporters of CDSS for continuing to give, so that individuals like Adam have more opportunities every day.”

– Gail Faulkner

Feeling inspired by Gail’s story? You can ensure more individuals like Adam have opportunities to thrive.

2. Continue the Good Work You’ve Started

Leaving a gift in your Will is a powerful way to reflect your values and make a lasting impact. Many donors tell us their contributions to the Canadian Down Syndrome Society are an investment in the Down syndrome community—bringing purpose, pride, and enjoyment.

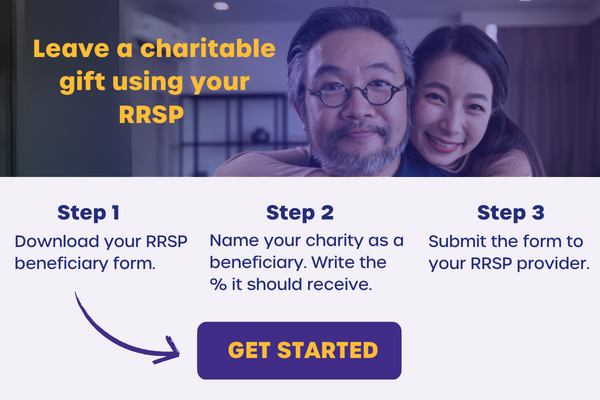

You can structure your donation to maximize tax benefits, like naming a charity as a beneficiary of your RRSP. This strategy can significantly offset taxes on these heavily taxed assets, easing the burden on your loved ones while keeping your legacy alive.

3. Create a Legacy That Inspires

Your gift can support meaningful causes, like inclusive education or employment opportunities for people with Down syndrome. Imagine the pride your family will feel knowing your generosity continues to change lives and inspire others.

4. Tax Breaks That Benefit Your Estate

Canada offers some of the world’s best charitable tax incentives. Donations can provide substantial credits to help reduce your estate’s tax burden, making your generosity impactful for both your cause and your loved ones.

A popular approach is to name a charity as a beneficiary of your RRSP, because the credit received will close to cancel out what would be owed on this heavily taxed asset.

If you’re interested to learn more, you can always book a consultation with a financial advisor who specializes in charitable giving.

How to Write a Will that Includes a Donation to Charity

It’s easier than you think. In fact, it can actually be fun to dream about the future and give shape to the mark you will make…

Step 1: Choose the charity or charities you’d like to support. It’s wise to book a chat with someone at your charity to talk about your options and make sure they can fulfill your future wishes. If you’re thinking about making a donation in your Will to CDSS, thank you. You can speak to Pamela at PamelaM@cdss.ca or 1-800-883-5608 Ext. 204. You won’t be held to any commitment, or sent any additional communications if you wish.

Step 2: Make sure you have their legal names and registration numbers. For reference our legal name is Canadian Down Syndrome Society, and our registration number is #11883 0751 RR 0001.

Step 3: Get a rough estimate of the size of your estate and what percentage you’d like to go to family vs. charity. The Will Power legacy calculator makes this really easy.

Step 4: Choose a lawyer, notary (if you live in Quebec or BC), or trusted online Will platform to draft your legal documents. You can find legal professionals who can help on the Will Power website too.

Step 5: Make sure your Will’s executor and your family know about your plans.

Need guidance? Speak to Pamela to explore your legacy giving options.

FAQs About Donating to Charity in Your Will

What about my family? I want to leave everything to them.

It’s possible to support both family and charity in your Will. Think about your Will in terms of percentages. If you set aside even 1% in your Will for charity you can make a big difference (and help pay down taxes). And you’re still leaving 99% to support loved ones. It’s a win-win.

I don’t have much to give.

You might have more than you think. For example, donors are often surprised to hear that the RRSP or life insurance policy they have through work can be a smart way to give.

It’s worth taking stock of your assets. Even a modest amount can make a big impact.

Do I have to be wealthy to leave a gift in my will?

No, it’s actually middle-income Canadians who typically give this way. Did you know that the average donation made in a Will, from the average Canadian, is thought to be around $35,000? That’s the power of gifts in Wills!

How will I know what my gift accomplishes?

It’s true that you will not be able to see your gift in action. But when you leave a donation to the Canadian Down Syndrome Society in your Will, you become part of the family. We share our future goals with you, and how your gift fits into the plan. Most of our legacy donors find they get closer to the cause.

What if I change my mind?

Remember, your Will is not set in stone. People generally update their Will at least a couple of times in your life. You can always make changes.

You might also consider tools outside your Will to make a legacy gift. For instance, you can name a charity as a beneficiary of your RRSP or life insurance policy, and make changes any time. No hassle, no fuss.

Am I too young to be thinking about this?

If you have any assets, you’re not too young to be thinking about what happens to them. Because if you don’t have a plan, the government (and CRA) do.

Is this all a bit morbid?

This is not about death. It’s about life; and your life specifically. It’s about the person you are, the values you demonstrate, and the example you want to set.

Not enough people think about their legacy, and take an active role in shaping it. It can be a very empowering process! If you have any questions Pamela Massaro, Senior Manager of Fund Development and Donor Management, can go into more detail with you. You can reach her at PamelaM@cdss.ca or 1-800-883-5608 Ext. 204.

Still have questions? Our team is here to help. Contact us today to explore your legacy giving options.

The Will Power campaign

CDSS is a partner in Will Power, a national awareness campaign that encourages Canadians to use their Wills as a force for good. Together with Will Power, we want connect people like you with resources to make the best decisions for their family, their future finances, and the causes that matter to them.